Your needs are your primary expenses, the things that you must pay every month. Here is a little help with dedicating funds. Your wants and emergency savings take second place.

Keep in mind: a budget should cover all your needs first. For that, it's good to divide expenses into wants, needs, and savings.įind a budget that you are comfortable with, while still putting money aside if possible. Have you tried putting it down on paper? Or better yet, an app?Īlthough apps can help, you still need to do some of the math yourself. Sometimes it seems that you take home way less than you need to cover all expenses. Prioritizing your needs over everything is a smart thing to do. You may not be able to fulfill all your wants each month. We all want to have enough money to put toward everything we want.

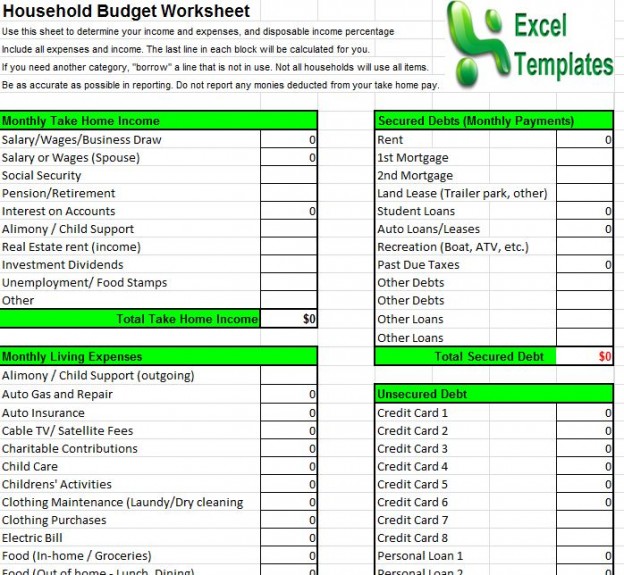

And the best way to never forget them is to keep a record. But with time, you can fix this by learning from your mistakes. Maybe at first, you will always fall a couple of hundred bucks short. Tracking your management process can lead to its improvement in the long run. The visual factor can help build an image of your expenses in your head. But many times, it will be easier to use online budgeting tools instead. You can make your own spreadsheet for this. You can add all those and subtract any business expenses you may have. You may have bonuses, tips, and multiple streams of income, perhaps even passive income. Your income can be more than just your salary. This is considered the golden budgeting rule. Meanwhile, 30% goes into your wants, and 20% goes toward savings. The biggest sum, 50%, goes into your needs, such as housing, utilities, etc. This is a rule where you divide your monthly expenses into 50%, 30%, and 20%. Even something as small as a $20 payment can subtract from your monthly budget.

HOUSEHOLD BUDGET CALCULATOR LIBRE MOVIE

You can also include your pet's food and vet bill, charitable contributions, movie tickets, new make-up, etc.ĭo you have any leftover credit card debt, or maybe personal loans that you haven't paid off? This is the section you fill out with those. But some may include needs too, such as childcare, clothing, a mobile phone bill, etc. Most of your personal expenses will be wants. If you've finished your schooling, you can include any student loan debt you have left. If your education is ongoing, you may want to include any supplies or books you buy. Health and dental insurance are also included in health expenses, along with routine doctor appointments.Įducation expenses look different for everyone. If you have monthly medicine expenses, you can add them here. Depending on how much you commute, at the end of the month, transportation expenses can be huge.ĭon't forget to add parking and tolls fees, and any tickets too. For others, this might be bus fares, metro fares, or even taxis. There can be more, but these are the most common among American households.įood is your groceries, as well as any take-out or dine-out you have during the month.įor many people, transportation is car expenses, such as insurance, loans, gas, and maintenance. To paint a clearer picture, your rent or mortgage, taxes, HOA fees, utility bills, and insurance.

Housing expenses include monthly payments that keep your house running (and some entertainment). It will show you how much money you have left. On the last calculator step (investments), find a calculate button.This way, you'll get the big ones out of the way. It's best to go in the order they are in the calculator.After this, you can start to input monthly expenses.Then, include any other extra cash you have monthly.First, input the combined monthly income of your family.Tricks to Stay Within Budget How Do I Use the Household Calculator?.

0 kommentar(er)

0 kommentar(er)